Daily Legislative Update for Saturday, March 4, 2023

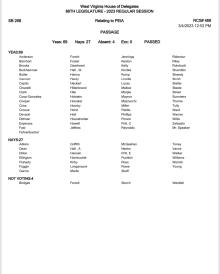

House Passes PEIA bill, SB 268 will go back to the Senate for concurrence

Amendments offered included:

--Delegate Summers moved to amend adding:

“"Device" means a blood glucose test strip, glucometer, continuous glucose monitor (CGM), lancet, lancing device, or insulin syringe used to cure, diagnose, mitigate, prevent, or treat diabetes or low blood sugar, but does not include insulin pumps.”;

And,

Adding a subsection (a) to read as follows:

“(a) A policy, plan, or contract that is issued or renewed on or after January 1, 2023 shall provide coverage for prescription insulin drugs and equipment pursuant to this section.”

And,

Inserting a new subsection (b) to read as follows:

“(c) Cost sharing for a 30-day supply of a covered prescription insulin drug may not exceed $35 in aggregate, including situations where the covered person is prescribed more than one insulin drug, per 30-day supply, regardless of the amount or type of insulin needed to fill such covered person’s prescription. Cost sharing for a 30-day supply of covered device(s) may not exceed $100 in aggregate, including situations where the covered person is prescribed more than one device, per 30-day supply. Each cost-share maximum is covered regardless of the person's deductible, copayment, coinsurance or any other cost-sharing requirement.”

AMENDMENT WAS ADOPTED

--Delegates D. Pritt, Skaff, Fluharty, Walker, Hansen, Rowe, Williams, Griffith, Young, Pushkin, Garcia and Hornbuckle move to amend the bill adding language that the spouse and dependent coverage is limited to excess or secondary coverage for each spouse and dependent who has primary coverage from any other source. For purposes of this section, the term "primary coverage" means individual or group hospital and surgical insurance coverage or individual or group major medical insurance coverage or group prescription drug coverage in which the spouse or dependent is the named insured or certificate holder. For the purposes of this section, "dependent" includes an eligible employee's unmarried child or stepchild under the age of twenty-five if that child or stepchild meets the definition of a "qualifying child" or a "qualifying relative" in Section 152 of the Internal Revenue Code. The director may require proof regarding spouse and dependent primary coverage and shall adopt rules governing the nature, discontinuance and resumption of any employee's coverage for his or her spouse and dependents.”

AMENDMENT WAS REJECTED

--Delegates Hansen, Skaff, Fluharty, Walker, Rowe, Williams, Griffith, Young, D. Pritt, Pushkin, Garcia and Hornbuckle move to amend by adding new language that states the aggregate cost sharing percentage of 80 percent for the employer shall be exceeded to prevent any employee premium cost share being increased by more than 10% from the employee’s previous year’s costs.”

AMENDMENT WAS REJECTED

--Delegates Skaff and Williams move to amend by inserting the following:

“or if the spouse’s employers plan is designed to pay less than seventy percent of the total cost of medical services for a standard population.”

AMENDMENT WAS REJECTED

--Delegates Steele & Burkhammer offered an amendment that strikes the language “Additional immunizations may be required by the Commissioner of the Bureau for Public Health for public health purposes.”

AMENDMENT WAS REJECTED

--Delegate Dean moved an amendment stating that “The 80/20 premium implementation begins with the 2025 fiscal year plan.”

AMENDMENT WAS REJECTED